Looking back, 2023 was quite a year! After a tremendously volatile 2022 that saw major market indices off by 20% or more, markets rebounded well in 2023. Here is how the year shaped up.

Stock Market Indices: Optimistic Gains

Each of the common stock market indices showed significant growth in 2023. The bond market also rebounded.

S&P 500: A Strong Rebound in 2023

Representing roughly 500 of the largest publicly traded companies in the United States, the S&P 500 saw a 26.29% increase in 2023. That was a turnaround from the -18.11% decline of 2022.

Dow Jones Industrial Average: Steady Gains in 2023

Similarly, the Blue-Chip Dow Jones Industrial Average finished 2023 up 16.18%, reversing the dip of -6.86% in 2022. This performance highlighted the resilience of major market indices.

NASDAQ Composite: A Remarkable Comeback

The technology-driven NASDAQ Composite Index had an impressive comeback, finishing up 44.64% in 2023. This was a welcome result after a challenging -32.54% return in 2022, showcasing the dynamic nature of tech markets.

Global Markets: MSCI EAFE Index Performance

Internationally, we rely on the MSCI EAFE as the benchmark index for companies based outside the U.S. The index touted a positive year, up 18.49%. This rebound came after being down -14.45% in 2022, indicating a global market recovery.

Bond Market Recovery: Positive Trends in 2023

The bond market turned in a positive year in 2023, being up 5.53%. Measured by the Bloomberg U.S. Aggregate Bond Index, that was good news following a 2022 result of -13.01%, the second of back-to-back down years for bonds.

Navigating Political and Economic Volatility

The year began with the continued turmoil surrounding the Russian invasion of Ukraine. In the spring, concerns around the health of our banking system arose with the collapse of Silicon Valley Bank, at the time the 16th largest bank in the U.S. Other regional banks also showed signs of strain but were ultimately buoyed by either Federal regulators or larger, more stable banks.

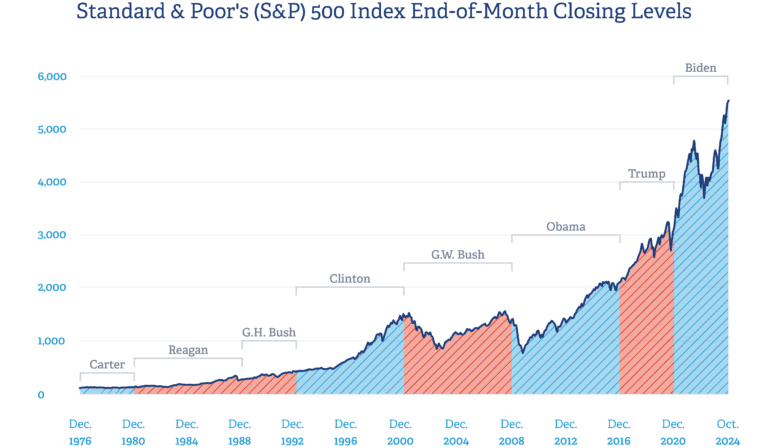

Political tension added to the volatility. Threats of government shutdowns loomed over the markets, but two shutdowns were averted by last-minute legislation passed by Congress. Additionally, a change in the Speaker of the House and the anticipation of a contentious 2024 presidential election left investors with more questions.

In the fall, the Israel-Hamas conflict drove more turbulence in the markets. September and October volatility started to counter gains made in the first part of the year. However, November and December helped 2023 finish strong. Investor confidence was renewed by encouraging sentiment from the Federal Reserve, citing rate cuts that could be coming in 2024.

Federal Reserve’s Impact on 2023 Markets

The Fed’s monetary policy to combat inflation resulted in four rate increases in the first part of 2023. The Fed Funds Rate, the benchmark interest rate for the U.S. economy, went from the low 4% range to over 5% by July. That action helped drive record inflation down from a high of 9% in summer of 2022 to just 3.1% in November 2023.

Looking Ahead to 2024

In total, 2023 turned out to be a positive year for investors. The markets showed resiliency through a number of challenges. 2024 will bring new hurdles as the federal government continues to address inflation and economic growth while navigating the next presidential election. Whatever the new year brings, Regency is optimistic for another promising year.