Financial planning requires a balancing act. While building and maintaining a readily available pool of cash—also known as a cash reserve—provides a safety net for your household finances, it’s crucial not to lose sight of your long-term financial goals. In today’s environment of relatively higher interest rates, it’s easy to unintentionally accumulate more cash than necessary, potentially missing out on the growth offered by long-term investments.

Why a Cash Reserve Policy Matters

Life throws curveballs. An unexpected expense, job loss, or medical emergency can disrupt your budget. A cash reserve acts as a buffer, giving you time to navigate challenges without relying on high-interest debt or dipping into long-term investments.

Factors Affecting Your Cash Reserve Needs

- Your Stage of Life: Young families with growing kids and uncertain careers may need a larger reserve than established couples nearing retirement

- Income Stability: Reliable, predictable income allows for a smaller reserve compared to fluctuating or uncertain income sources.

- Upcoming Expenses: Anticipated large purchases, like a car or a down payment on a home, may influence your reserve amount.

- Risk Tolerance: Those comfortable with some financial risk may hold less cash, while those seeking greater security may prioritize a higher reserve.

Consider Two Example Scenarios

- Mary and John: A married couple in their 50s with stable income and no dependents. They can likely afford to maintain maintain a smaller cash reserve due to their financial stability, prioritizing wealth building.

- The Millers: A young family with a newborn, variable income, and potential childcare costs on the horizon. They may need a larger reserve to handle unexpected expenses and provide a financial cushion.

Cash vs. Long-Term Investments

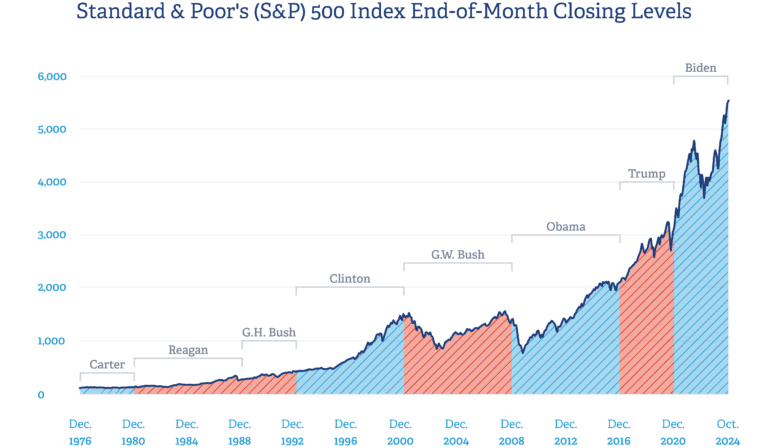

While cash offers easy access and security, it’s not suitable for long-term wealth building. Cash has historically outperformed inflation by a small margin. The goal of a long-term plan is to grow your wealth at a rate that can exceed the rate of inflation over time. Can you have too much cash? Absolutely. This was especially the case in 2022 when some investors fled to cash and money markets as a safe haven from stock and bond market volatility. Reallocating to cash during volatile markets creates a short-term sense of relief. However, it also creates long-term complexity as it is difficult to time when to get back into the investment markets. Investors with too much cash should realize that while they don’t see further short-term losses caused by market volatility, inflation risk will create a loss of purchasing power over time. History has taught us what a dollar can buy today it won’t likely buy in ten years. A good solution to this problem is a cash management policy within your long-term financial plan.

Looking at compounded returns from 1974-2023 emphasizes the importance of a long-term focus. Stocks (S&P 500) compounded at over 11%, bonds (10-year treasuries) did 6.12%, and cash (3 month T bills) earned 4.30%. Those differences may not seem large individually, but a $1,000 investment in each asset class would have grown to significantly different amounts: $192,875 (stocks), $19,536 (bonds), and only $8,223 for cash. (Source: NYU.edu)1

The Takeaway

Establishing a cash reserve policy gives you control over your finances. By considering your unique circumstances, you can determine the optimal amount of cash to hold for peace of mind without sacrificing long-term financial goals.

1Past performance is not indicative of future results and inherent in any investment in the market is the possibility of loss.