Navigating the world of financial advice can be overwhelming for consumers. With countless options, financial jargon, and an alphabet soup of industry credentials, choosing the right professional feels like deciphering a complex code. Read on as we guide you through simplifying your search by highlighting how powerful the combination of a CERTIFIED FINANCIAL PLANNER™ and a Registered Investment Adviser (RIA) firm can be for your financial well-being.

What is a CERTIFIED FINANCIAL PLANNER™?

A CFP® professional is a financial advisor who has gone through rigorous coursework, training, experience requirements, and continuing education to earn the prestigious designation from the Certified Financial Planner Board of Standards (CFP Board). This designation signifies competence in numerous areas of financial planning (estate planning, tax, risk management, retirement, college planning, etc.), ensuring they can assist with various aspects of your financial needs, not just investments.

1. Combined Expertise

Blending the financial planning skills of a CFP® professional with the investment management capabilities of an RIA firm creates a comprehensive approach. We can compare a CFP® professional to your family’s general practitioner. Just as a general practitioner has a thorough understanding of health and can address various needs, a CFP® professional possesses holistic financial knowledge to charter clients through diverse areas of financial advice. These include retirement planning, budgeting, and estate planning. Conversely, RIAs specialize in investment management, similar to a specialist that your doctor might refer you to for a specific health concern.

2. Fiduciary Duty and Transparency

Both CFP® professionals and RIA firms are held to the highest ethical standards. CFP® professionals adhere to a fiduciary duty, adopting the CFP Board’s Code of Ethics and Standards of Conduct. Similarly, RIA firms operate under a fiduciary standard, ensuring their recommendations prioritize your financial interests, not their own. Additionally, some RIA firms (including Regency) operate on a fee-only model, providing fee transparency and reducing potential conflicts of interest driven by commissions on specific products.

3. Ongoing Support

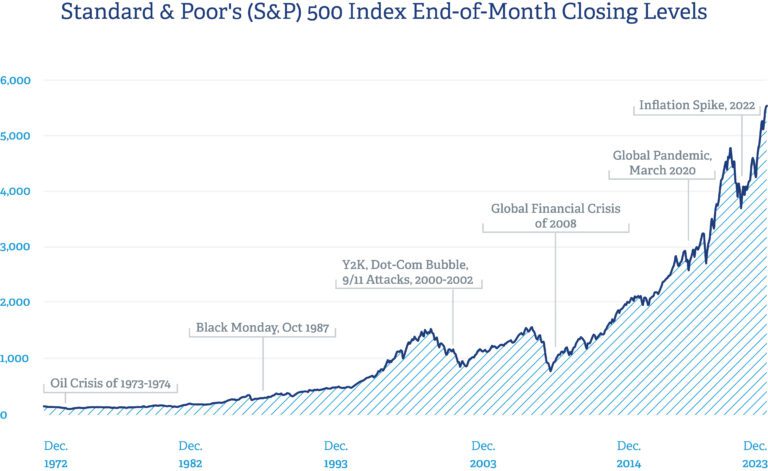

Building a long-term relationship with a CFP® professional and an RIA firm fosters trust and confidence in your financial planning journey. A financial plan should not be a one-time analysis. Your CFP® professional should offer ongoing financial advice tailored to your evolving needs, helping you navigate life events and market uncertainty.

4. Specialized Knowledge and Resources

Look for a CFP® professional who holds additional wealth management specializations relevant to your specific needs, like retirement or estate planning. A few specializations worth considering:

- CFA® (Chartered Financial Analyst)—Investment/Portfolio Management

- CRPC® (Chartered Retirement Planning Counselor)—Retirement Planning

- RICP® (Retirement Income Certified Professional)—Retirement Income Planning, Social Security, Medicare

RIA firms often have access to a wider range of investment products and research compared to individual investors, allowing their financial planners to tailor your portfolio to your unique goals and risk tolerance.

5. Peace of Mind and Empowerment

Partnering with both a CFP® professional and an RIA firm allows you to focus on life’s priorities while knowing your financial planning is in capable hands. It can be challenging to make informed investment decisions without the professional context of how it will affect your overall financial goals. Working with an experienced financial advisor can help you see the whole picture.

Working with a CFP® professional and an RIA firm offers a comprehensive solution: holistic financial planning from an experienced financial advisor and sound investment management from an RIA, all while prioritizing your goals and best interests in the name of fiduciary duty.