The presidential election is less than a month away, and as in previous elections, investors’ emotions, both fear and optimism, are running high. It can be difficult to avoid being swept up in the rhetoric of a presidential election. Elections are emotionally charged, sparking conversation and debate among family, friends, colleagues, and even strangers. And the media certainly adds fuel to the fire. The biggest question from investors is what action, if any, should we take with our investments with respect to the election?

How the Market Has Fared in Election Years

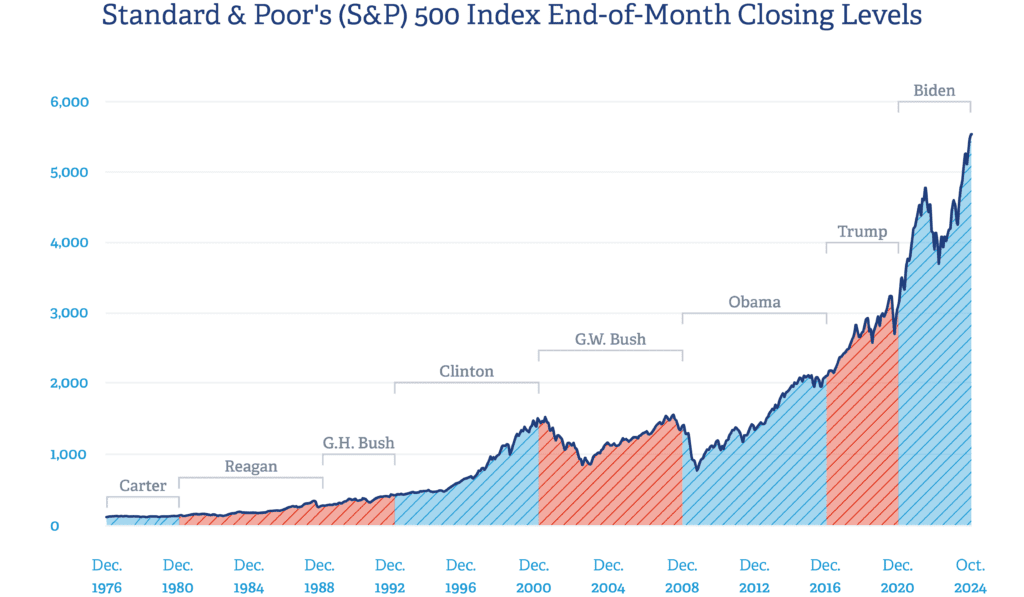

You may find it interesting to learn that the U.S. stock market has performed well in election years, regardless of the election outcome. Going back to Jimmy Carter versus Gerald Ford in 1976, there have been 12 presidential elections. And in that nearly 50-year period, the actual years in office between the two parties is just about even. Democrats won six times starting with Carter in 1976, Bill Clinton in 1992 and 1996, Barack Obama in 2008 and 2012, and Joe Biden in 2020. Republicans won six times as well: Ronald Reagan in 1980 and 1984, George H. Bush in 1988, George W. Bush in 2000 and 2004, and Donald Trump in 2016.

Red or blue, the market has fared well in those election years. Using the S&P 500 as our guide, the market was positive in ten of those 12 presidential election years. And eight of those positive ten years were double-digit growth years!

The only two presidential election years over this period where the S&P 500 ended in negative territory were 2000 and 2008. Both were attributable to very specific market conditions from which the market later rebounded. In the year 2000, a combination of the Y2K computer date event and the bursting of the Dot-com bubble led to a 9.1% downturn in the S&P 500. 2008 was characterized by the Global Financial Crisis which saw the index fall 37% for the year.

Performance of the S&P 500 Over Election Periods

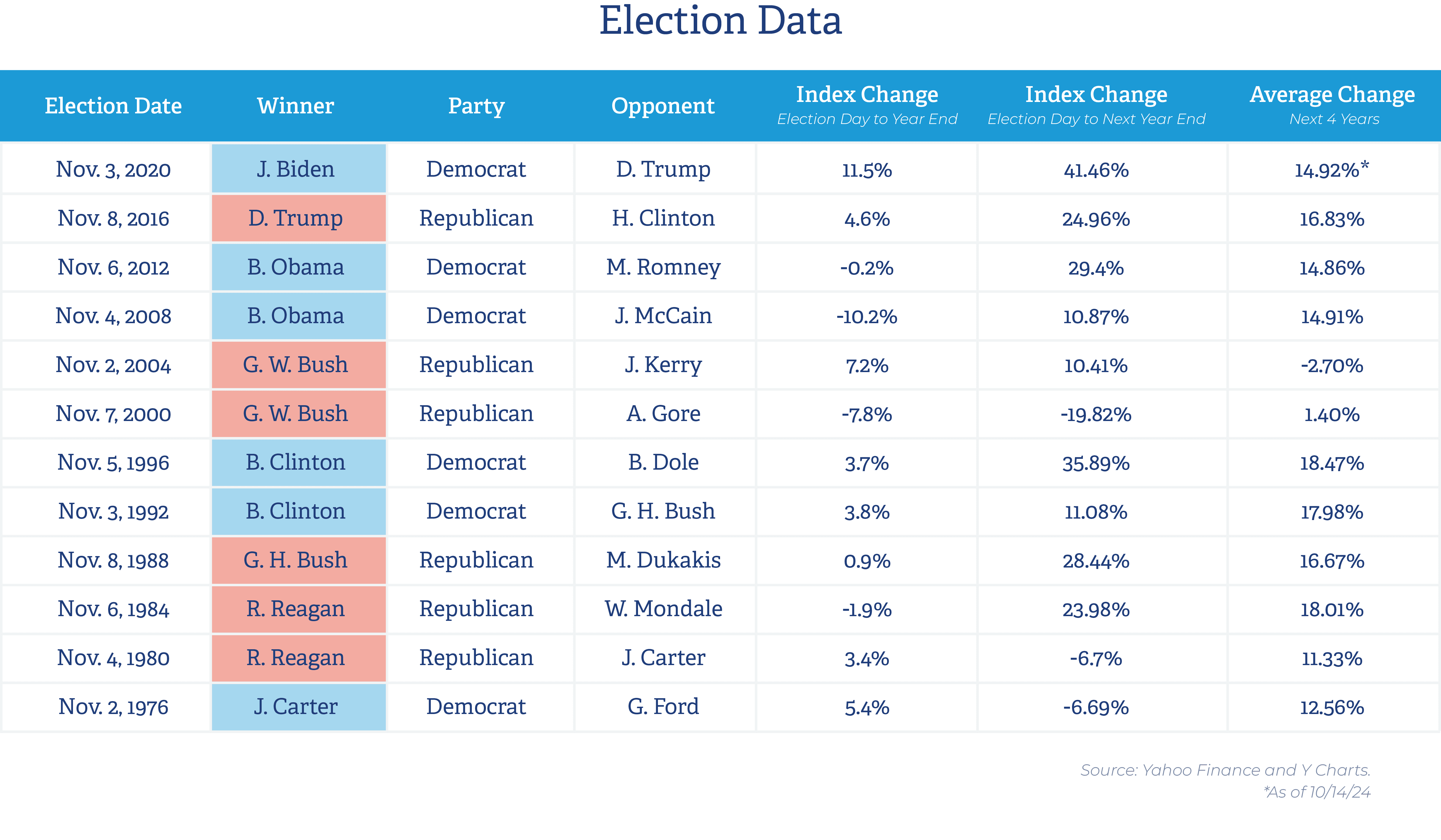

Let’s look at how the S&P 500 has performed over the previous twelve election periods. The table below examines:

- How the index performed from election day to year-end

- How the index performed from election day to the end of the following year

- The average growth in the index in the four years following the election

As a reminder, past performance is not indicative of future results, and inherent in any investment in the market is the possibility of loss. There are inherent limitations in making assumptions due to the cyclical nature of investments.

Looking to the Future

The moral of the story? The U.S. stock market, the economy, and the financial markets are complex systems, influenced and driven by numerous factors, only one of which is the outcome of the election. Regency continues to believe it is time in the markets, not timing the markets, that gives investors the highest probability of long-term success. If you have concerns about your portfolio, please contact us to schedule a conversation with your adviser.